Thinking of putting money in Roboadvisr? Here's your guide to understanding Roboadvisors

Your 101 introduction to Roboadvisors and how it works

If you are an investor or have been thinking about starting your investment journey, then you may have heard of roboadvisors. The word, roboadvisor comes from the combination of words “robot” and “advisor”.

If this is your first time hearing about it, here is a simple way to understand it:

It’s investing made easy with the help of an algorithm

The first roboadvisor started in Singapore in 2015. Since then, especially during the pandemic, roboadvisors have become increasingly popular with more players entering the industry. To date, there are about 10 roboadvisors operating in Singapore. While it is great that there are more options now, it can also be daunting having to choose among them. But this is not a comparison article, rather, in this article, we will be explaining in general how roboadvisors works, how they earn, and perhaps some words of caution. This is an important step as it helps you to set realistic expectations and understand the potential risk before

A more comprehensive understanding of roboadvisors

Earlier we mentioned that Roboadvisor helps you invest your money with the help of the computer or an algorithm, to be specifc. Knowing that is generally good enough to get started, but it will be also useful to have a deeper understanding of how it works. In particular, it can help you form and manage expectations and make a more informed decision when the returns aren’t doing as well.

Im summary, roboadvisor generally utilise fancy algorithms to help make investment decisions.

To understand how the algorithm helps the roboadvisor with investing, it will be helpful to know the basics of programming.

What is an algorithm?

Essentially, an algorithm is just a set of rules. For example, if you are coding a robot to cook an egg:

A code example would be something like:

-

Prepare the stove

-

Add 5ml of oil

-

Crack the egg and put it in the pan

-

Stir the pan for 2 mins

-

Take out the egg

What you see here is an example of what an algorithm may look like. As you can see , an algorithm just boils down to a set of rules.

Referencing back to how a roboadvisor works, in its simplest form, it will simply ask you a set of questions, such as how long will you be investing, how much you earn, etc. Based on your answer to these questions, the roboadvisor will run through these pre-defined set of rules and come up with the recommended portfolio for you.

Roboadvisor in Singapore

Many of the roboadvisors in Singapore utilise sets of pre-labeled portfolios that are pre-designed based on your risk level. i.e. there is a portfolio shared by people with risk levels 1–3 and another for someone with different risk tolerance etc.

The next and more important question would then be, how are the underlying asset chosen in each portfolio chosen? To simplify it, algorithms. But of course, it is much more complicated than the example we gave earlier.

Referencing back to the robot cooking the egg example, it may look simple, but there are many things that have yet to be addressed. For example, how strong should the fire be, does it matter in which how the egg is prepared? Here is where the algorithm can get increasingly complicated and it becomes more of an art and science rather than just a pure set of rules.

When it comes to choosing the underlying assets in each risk portfolio, here is where roboadvisors differs greatly from one another. In other words, the investment philosophy or methodology are different from one another. Here are some of the examples of the methodologies used by existing roboadvisors to pick the underlying stocks:

StashAway — Economic Regime Based Asset

Syfe — Smart Beta Strategy

Endowus (Core Flagship Portfolios) — Systematic Portfolio Optimization

Are any of these methodologies, more superior to each other? No one knows exactly. Some may have their own opinion, but definitely, they all have their pros and cons. After all, there must be a reason why they are all using different strategies.

As with our example of a robot cooking an egg, the different methodologies could be like the different styles of cooking. Is there a best style- scrambled or sunnyside up? Maybe. But it is hard to judge until you taste the final product, even then it depends on your taste bud.

How much do you need to understand?

If you are someone with no background and interest in investment, it can be extremely difficult to understand the roboadvisors investment methodology. So instead of trying to comprehend what all of the roboadvisor are doing, we suggest shortlisting to a few and just having a high-level understanding of what they are doing.

Back to our cooking egg example, you may never need to know, how the egg that’s been served is prepared. But it can be much more assuring to at least know the ingredients used and a rough idea of how is it prepared.

What’s more important is also to understand, that even though the methodology that these platforms used may be very sophisticated, it does not mean that they will always be good for your buck.

How do Roboadvisor earn/charge?

Most roboadvisors earn by charging a platform fee on the investment you have with them.

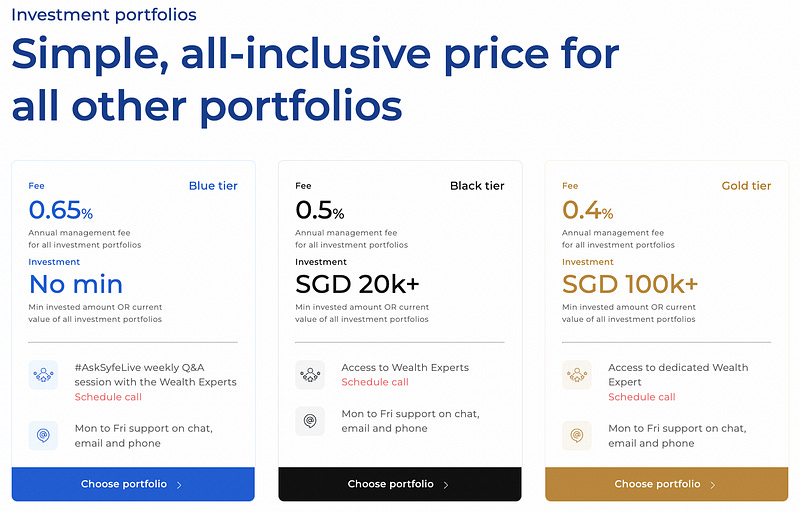

For example, if the roboadvisor charges 1% that would mean that they are earning $1 for every $100 you put in with them. This would usually be lesser the higher your AUM or more you invest with them. Such example would be a fee of 1% for the first $10k invested and 0.8% if you more than invested. Ofcourse, these fees would differ with each roboadvisor.

Here is an example for Syfe roboadvisor:

source: Syfe- Pricing

Why does it matter?

Understanding how Roboadvisors earn is important, as it reflects the business model and longetivity of the it.

In other words, if the roboadvisor doesn’t earn enough, chances are they won’t be around for long or may default- which has happened before. And if there is ever a time where they were to close down, even though you will not lose all your money, you may be required to liquidate all assets immediately and thats definitely not a pleasant experience.

Conclusion

Roboadvisor is a great way to invest without spending too much time researching and doing the intensive “homework”. Nevertheless, it is still important to understand where you put your money. Afterall, no one cares about your money more than you do.