Term v.s. Life Insurance

Answering the big question with math

When it comes to getting critical illness insurance coverage, the first decision that one will have to make is whether to go for a term or a whole life plan. If you do a quick google search on this matter, chances are you will find many people suggesting to get the former and invest the rest. But is it really that simple? In this article, we will explore a few possible situations and deep dive into the reason why one may be better suited for each given situation.

Understanding Term and Whole life plan

Term Plan

Term plan, as the name suggests, provide you with coverage for a term. It is almost like renting a house, where you pay for as long as you want to be a tenant. Your coverage ends when you stop paying and whatever that you have paid previously will not be recoverable.

Whole Life Plan

Unlike a term plan, a whole life plan usually provides protection up to the age of 100 years old. Generally, a whole life plan has a limited payment term. This means that you only have to pay for a number of years and you will be covered up till you are 100 years old. It is almost like buying a BTO in Singapore, you pay for your house mortgage and once it is paid finished the house is yours. But for HDB when your 99-year HDB lease is up, your flat value goes to $0 whereas for a whole-life plan a lump sum of cash known as maturity value will be given to you at the end of the whole-life plan or when you choose to surrender before it ends.

The similarity between Term and Whole Life plan

In general, both Term and Whole life insurance provide you coverage in the following events:

-

Death

-

Terminal Illness

-

Total Permanent Disability

-

Critical Illness

Note: Not all term/whole life plans provide these coverages, in some cases you will need to add-on to the plan to get all these coverages.

Main Differences between Term and Whole Life plan

Background Information

Both the cost of term and whole life plan greatly depends on an individual’s age, health status, gender and whether they smoke. In order for a fair comparison, this is the information that will be held constant throughout the entire comparison:

-

24-year-old Female

-

Non-smoker

-

Wants a coverage of $100,000 for death and early critical illness.

Since the purpose of getting coverage for death, critical illness, etc differs greatly, in this post we will be focusing on getting coverage for early critical illness.

Situation 1: Using coverage to cushion temporary income loss

When one is diagnosed with a critical illness, chances are they would want to take a break from work. This would mean that they would have a temporary loss of income. To learn more about the possible cost that comes from getting a critical illness, do check out this article that we wrote previously.

The Hidden Cost of Critical Illness

The actual cost of Critical Illness that no one talks about and how to mitigate itmedium.com

The payout from insurance is a good way to cushion the loss of income when it comes to critical illness. This is often one of the main reasons one would choose to get early critical illness coverage. Given that the purpose is to just cushion the temporary income loss, it would make sense to seek coverage that covers up till the age where we are still earning an income. In other words, there wouldn’t be a loss of income if you have already retired

Let’s assume that the 24-year-old wants to retire at age 65. She would either get term insurance that covers her up to 65 years old or a whole life plan and surrender at 65 years old.

Running the math

Unfortunately, the cost of the specific insurance can’t be found easily on the internet. So in order to compare these two plans, we will be using the information that we have gotten from insurance agents. (Due to legal issues, we will not be disclosing the name and identity of this plan.)

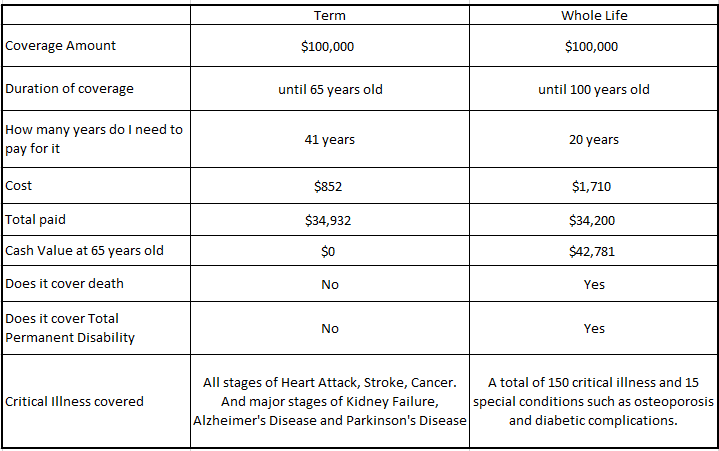

Term plan

This term critical illness plan covers Heart Attack, Stroke, Cancer at the early, intermediate and major stages. It also covers Kidney Failure, Alzheimer’s Disease and Parkinson’s Disease at the major stage. It is definitely not the most comprehensive plan, but it does cover the most common ones.

For a 24-year-old non-smoker female, it will cost her $852 per year (payable for the next 41 years) for coverage of $100,000 until the age of 65 years old.

Whole Life Plan

The whole life plan, covers death, total permanent disability and critical illness of all stages until the age of 100 years old. Unlike the term plan that we mentioned previously, it covers a total of 150 multi-stage critical illnesses and 15 special conditions such as osteoporosis and diabetic complications. We know that the whole life plan in this comparison has much more coverage and may not seem like a good comparison, but this is what we have to compare.

For a 24-year-old non-smoker female, it will cost her $1,710 per year (payable for the next 20 years) for coverage of $100,000 until the age of 100 years old.

Plan Comparison

Once again, for a 24-year-old non-smoker female, this is how it will look like.

Just by looking at this table, it seems like the whole life plan is the clear winner. Despite the premium (‘cost’) of the term plan being cheaper, it has to be paid for 41 years. So in totality, the Term plan might seem to be more expensive than the whole life plan. On top of that, the whole life plan seems to be a better bargain given that the coverage is much more comprehensive and has a cash value of $42,781 at the end of 65 years old.

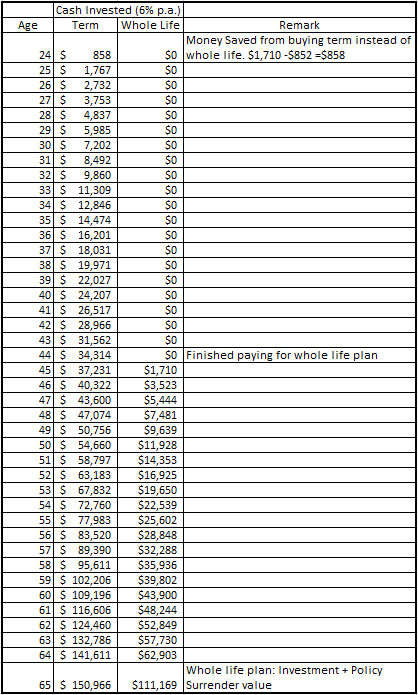

Before jumping to the conclusion that the whole life plan is better, we should also look at the opportunity cost. What if we follow the advice on the internet, to buy a term plan and invest the rest?

Based on the ideology of buying a term plan and investing the rest, it seems like you will end up with more cash at 65 years old. With buying term having a lead of $39,797. This extra cost of $39,797 that is spread over 40 years is most likely overstating the difference. After all, the whole life plan in this comparison has much more coverage. But of course, the investment return at 6% p.a. might be conservative, if the annualised investment return were to generate a higher return then the gap would be even bigger.

So which to choose?

If you are buying yourself coverage purely for income replacement while you are working and simply want to cover yourself over the common illnesses that are covered in the term plan, a term plan may be better suited for you. But most importantly, you must also have the discipline to invest consistently over 40 years for a term plan to be worth it. Which is harder than most people think because life happens.

Another thing to note is that it would be a lot harder and expensive to get a whole life plan at a later stage should you decide to have coverage beyond your retirement years.

Situation 2: Using coverage to readjust your lifestyle

Sometimes getting critical illness coverage isn’t simply just about replacing your income, it is also about readjusting to a new lifestyle. For example, if someone were to be diagnosed with Alzheimer’s Disease his/her family might want to hire a caregiver. If you would want to insure yourself in such a situation, you would need some form of coverage even after retirement. In fact, the chances of getting Alzheimer’s Disease usually increases as one age.

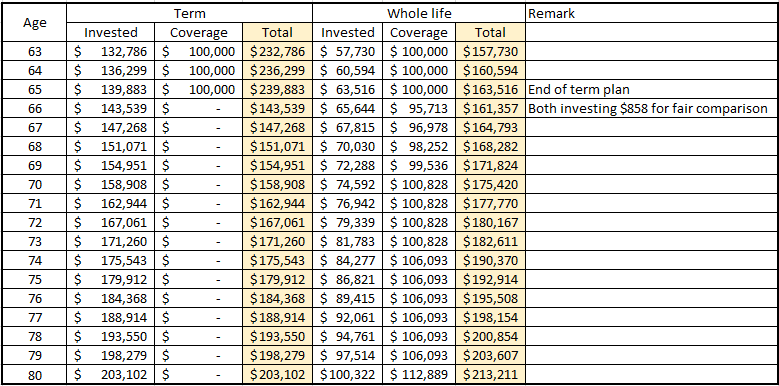

To compare the plans in this situation, we will be using the same term and whole life plan we’ve used in the previous situation. However, the term plan only provides coverage up to the age of 65. Therefore, if you were to opt-in for a term plan for this situation, you would have to fork out your own “coverage” after the term plan ends.

**How to read the table

**The value of the table is mostly from the continuation of the previous example. The coverage column for the term plan stops at 66 years old simply because the term ended.

To have a fairer comparison, we will look at both the invested column plus the coverage for both term and whole life plan. We have also decided to reduce the cash investment to 2% for both whole life and term because, at that age, you probably wouldn’t be taking as much risk when it comes to investment.

The reason why the whole life coverage drops at 66 years old is because of the multiplier effect of a whole life plan (more on that next time).

**Takeaways from the table

**From the table above, you can see that in this given situation, you will end up with more assets if you picked a Whole life plan. On top of that, if you recall, the whole life plan that we picked in this situation has much more coverage than the term plan.

Of course, things may be different if you are able to achieve more and have a much higher investment return. But realistically speaking, at that age growing wealth is probably not your concern.

So which to choose?

If you want to be covered by insurance even after you retire then a whole life plan might be a better choice for you. Although the asset you have at that age may have surpassed the payout that an insurance company can offer you, it may be wise to separate what is meant for your retirement/legacy with insurance.

To add on, as a personal opinion, it certainly feels a lot better to be receiving money for your medical treatment than using your own money.

Caveat

The policies that we compare in this article may not be a good representative of term or life insurance. Because of this, the conclusion, drawn in the situation may not be as accurate. However, we hope that it provides you with the right knowledge of how to compare the term and life plans of your choice.

If you are in Singapore and wish to find out more about getting yourself the right type of coverage, simply fill up this form and our trusted advisors from DaretoFinance will contact you.

Conclusion

The battle between term or life plans isn’t as simple as picking the one with the most value for money. There are many factors that need to be considered, for example, what are you actually covering for and your risk tolerance. Additionally, accounting for when you would need it most and preparing for it. A point often overlooked is noting at what your term insurance expires and if you ever decide to have coverage after retirement, it may be too late to do so.

Ultimately, insurance is a tool to manage risk, there isn’t any best option, but an option that fit your needs.