Top Strategies to Reduce Your Tax in Singapore for 2025: Maximize Tax Relief and Savings

Discover Tax Relief Methods, CPF and SRS Contributions, and Donation Strategies to Optimize Your Tax Savings in Singapore.

As the year draws to a close, it’s an opportune moment to explore strategies to reduce your taxable income for the upcoming Year of Assessment (YA) 2025 in Singapore. It’s that time of the year again to do some last min tax relief. In fact, if you’re reading this today, you are left with less than a month to reduce your taxable income.

To help you get up to speed, we’ll be covering the basics of tax and tax relief strategies, and a couple of case studies for you to analyse and determine how you can plan out your tax relief strategy.

Understanding Chargeable Income and Tax Rates

To effectively plan your taxes, it’s crucial to understand how income is taxed in Singapore and what qualifies as chargeable income. Chargeable income refers to your total taxable earnings for the year after deducting eligible expenses. Essentially, any income earned in Singapore during the year is subject to taxation.

This includes various sources such as salaries and other income such as rental income.

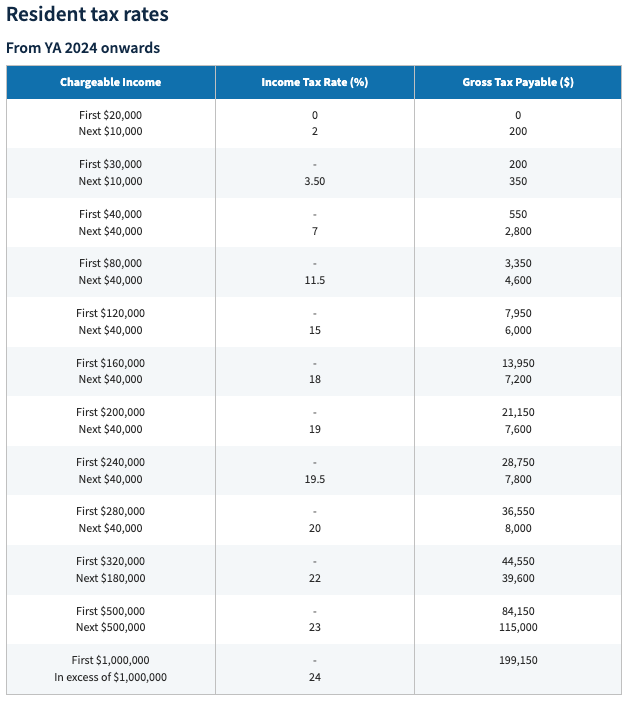

Chargeable income in Singapore is your total taxable income minus deductible expenses and applicable reliefs. Singapore employs a progressive tax system, meaning higher income levels are taxed at higher rates. For YA 2025, the personal income tax rates for residents are as follows:

Singapore Resident Tax Rates 2024

Source: IRAS

Let’s break down how Singapore’s tiered tax system works with a practical example:

| For an individual with an annual income of $35,000 here’s how it will look like | ||

|---|---|---|

| Income Bracket | Tax Rate | Tax Amount |

| First $20,000 | 0% | $0 |

| Next $10,000 | 2% | $200 |

| Remaining $5,000 | 3.5% | $175 |

| Total Tax Payable | $375 | |

This progressive system ensures fairness by only applying higher tax rates to income that falls within each bracket. In this example, even though you earn $35,000, not all of it is taxed at the same rate - the first $20,000 remains tax-free.

How Tax Relief Works in Singapore

Tax relief allows you to lower your chargeable income by utilising specific reliefs and deductions, thereby reducing the amount of income tax you need to pay. By contributing to approved schemes or meeting eligibility criteria, you can significantly optimise your tax savings. This is what we would mainly cover in this article.

Personal income tax reliefs in Singapore are subject to a cap of S$80,000 per Year of Assessment (YA). Some reliefs, such as child relief and earned income relief, are automatically applied. However, others, like CPF cash top-up relief and Supplementary Retirement Scheme (SRS) contributions, require manual declaration to claim— so read on to know what you got to do.

Source: IRAS Guide for Individual Taxpayers

Tax Relief Timeline in Singapore

Tax relief efforts are assessed annually based on income earned during the preceding calendar year, which ends on 31 December. To benefit from tax relief in a given YA, contributions or eligible actions must be completed in the prior calendar year.

If you miss the filing deadline, the Inland Revenue Authority of Singapore (IRAS) may issue an estimated tax assessment. Tax bills for personal income are typically sent between May and August of the following year.

Types of Tax Relief in Singapore

Proper planning of your tax relief strategy is essential to maximise savings. While you can aim to fully utilise the S$80,000 relief cap, it’s important to ensure that your financial goals and cash flow are not negatively impacted. Effective tax relief planning may even lower your chargeable income enough to fall into a lower tax bracket, further reducing your overall tax liability.

Automatically Applied Tax Reliefs

Here are some tax reliefs that are granted automatically if you meet the eligibility criteria that we mentioned earlier. These include:

- Child Relief

- Earned Income Relief

- Parent Relief

- Grandparent Caregiver Relief

Always review your Notice of Assessment (NOA) to ensure these reliefs have been correctly applied.

Source: IRAS Tax Reliefs Overview

Tax Reliefs That Require Application

Now here’s what most of us are here for. Certain tax reliefs require proactive action and declaration to IRAS. These include:

- CPF Cash Top-Up Relief: For contributions to your or your loved ones’ Special Account (SA) or Retirement Account (RA).

- Supplementary Retirement Scheme (SRS) Relief: For voluntary contributions to an SRS account.

- Course Fees Relief: For approved educational courses aimed at skills upgrading.

Understanding and applying for these reliefs can help you optimise your tax savings. The next sections will provide detailed information on each manual application process.

Maximising Tax Reliefs

Singapore offers various tax reliefs to encourage savings, support families, and promote social contributions. It’s crucial to note that the total personal income tax reliefs are capped at $80,000 per YA.

Key Reliefs to Consider

1. Central Provident Fund (CPF) Cash Top-Up Relief

- Self-Top-Up: You can claim relief for cash top-ups to your own Special Account (SA) or Retirement Account (RA), up to the current Full Retirement Sum (FRS). The relief is capped at $8,000 per calendar year.

- Top-Up for Loved Ones: An additional relief of up to $8,000 is available when you top up the SA or RA of your loved ones, such as your spouse, siblings, parents, or grandparents. Ensure that your spouse or siblings have an annual income not exceeding $8,000 in the previous year to qualify.

Learn more about CPF Cash Top-up Tax relief

2. Supplementary Retirement Scheme (SRS) Contributions

- Contributions to your SRS account are eligible for dollar-for-dollar tax relief, capped at $15,300 per year for Singaporeans and Permanent Residents, and $35,700 for foreigners.

- This scheme encourages retirement savings beyond the CPF.

To learn more about SRS check out this article

3. Charitable Donations

- Donations to approved Institutions of a Public Character (IPCs) qualify for a 250% tax deduction.

- For every $100 you donate to an approved organisation, you can reduce your chargeable income by $250. Learn more here

Strategic Planning for Tax Savings

To effectively reduce your tax liabilities, consider the following strategies:

- Assess Your Income Bracket: Identify your current chargeable income and determine how much relief is needed to move to a lower tax bracket, thereby reducing your overall tax rate.

- Plan Contributions Wisely: While maximising reliefs is beneficial, ensure that contributions, especially to CPF and SRS, align with your financial goals and liquidity needs, as these funds are generally locked in until retirement.

- Leverage Automatic Reliefs: Some reliefs, such as earned income relief and NSman (Self/Parent) relief, are automatically granted if you qualify. Review your Notice of Assessment to ensure all applicable reliefs have been applied.

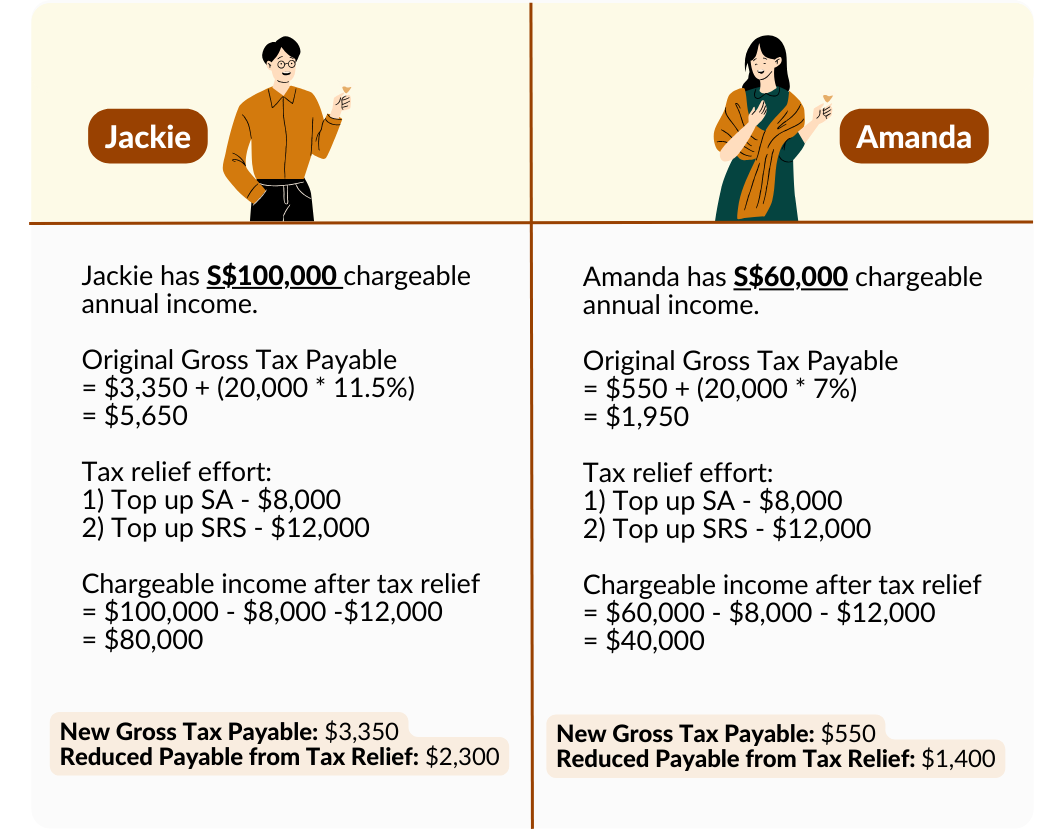

Case Study: Tax Relief in Action

Singapore Resident Tax Rates 2024 example

Although Jackie and Amanda contributed the same amount to their SA & SRS for tax relief, Jackie saved 60% more than Amanda. This is mainly due to the higher income tax rate for higher-income earners. So if you belong to the higher income bracket, you can definitely save more with these schemes.

Key Takeaways for Tax Relief in Singapore

- Plan Early: Ensure tax relief actions, like contributions or donations, are completed before 31 December to be eligible for the next YA.

- Understand Eligibility: Review which reliefs are automatically applied and which require manual application to avoid missing out on potential savings.

- Align with Financial Goals: Use tax reliefs strategically, ensuring they fit into your overall financial and retirement planning.

By carefully planning and leveraging the available tax reliefs, you can minimise your tax burden while securing a more robust financial future.

Conclusion

Implementing tax relief strategies requires careful planning and consideration of your financial circumstances. While the prospect of tax savings is appealing, it’s essential to ensure that any contributions or donations are sustainable and align with your long-term financial objectives. By staying informed and proactive, you can make the most of the available reliefs and optimise your tax position for YA 2025.