Should you do your own investment

Things to consider before you start your investment journey

As a new investor, the idea of navigating the world of investments can be daunting. The choices and decisions can seem overwhelming, especially when it comes to deciding whether to manage your own investments or hire someone to do it for you. It’s a decision that requires careful consideration and research, but it’s important to remember that you don’t have to go through this process alone.

In this article, we hope to provide you with a comprehensive guide that will help you weigh the pros and cons of both options, so that you can make a decision that aligns with your goals, risk tolerance and financial situation. With the right knowledge and support, you can take control of your finances and embark on a successful investment journey.

Regardless of outsourcing or do-it-yourself (DIY) investing, it can be more expensive to stay uninvested. That’s why we’re breaking this question down for you, on hidden “costs” to consider too.

What does staying invested means?

Staying invested may be one of your strategies to beat inflation, grow wealth, or diversify your income to secure your future. As such, one may hope to create a sound portfolio that will tide through various economic changes that are consistent and continuous based on your investing time horizon. Indeed, the consistency and confidence in creating such a portfolio may require some years of experience and the foresight to see the bigger picture. It is not impossible, but how?

Before taking the next step to invest, we recommend ensuring the following are worked on first:

-

Prioritise understanding your expenses before investing. (clearing debts, having emergency savings, and being sufficiently insured)

-

Don’t invest what you’ll need in the short term because nothing is guaranteed.

How to decide DIY or Outsource: Top 3 considerations

DIY or Outsourcing are simply investing styles that may suit your needs at different stages of your investing time horizon. Instead of choosing the cheapest investing fees, it’s wiser to have suitable and sustainable investment strategies for the long marathon.

These are 3 important but lesser-mentioned considerations that can give you more clarity:

- Emotional Competency and Risk Appetite

One question to determine your own emotional competency and risk appetite could be: Are you able to stay rational and make sound decisions when the market is red? Perhaps, if you’re emotionally attached to numbers, volatile losses and red markets are stressful for you, adopting conservative investing strategies may be ideal for a lower risk appetite. On the other spectrum, having greater emotional competency and risk appetite often comes with more experience and having done proper financial planning.

2. Time

In reality, we’re all strapped for time in our bustling lifestyle, and choosing between saving time or money can still incur hidden opportunity costs that we have to bear. It’s fine to prioritise spending time with family instead of deep-diving into the next emerging market or the next rising company, it only means you would prefer investing style that takes lesser time.

3. Investment Competency and Interest Level

Investing can seem like a daunting task, especially if you’re not well-versed in jargon or technical analysis. While having a deep understanding of these concepts can certainly benefit your portfolio, it’s important to consider your level of interest as well. After all, investing is a long-term commitment, and it’s crucial that you enjoy what you’re doing. If you find yourself lacking the motivation to stay up-to-date with the latest news or learn about new investment products. Then it may be worth considering a more hands-off approach towards investment.

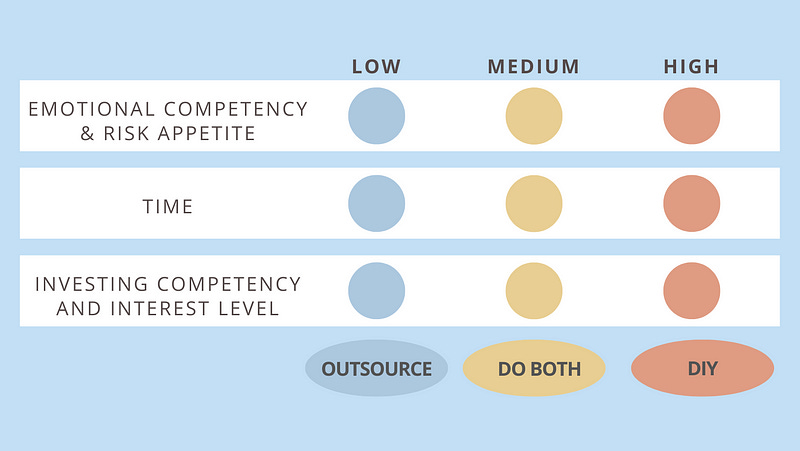

As above, these 3 factors can influence your investing style, whether it’s ranked low or high for you, there are more than just “fees” that you can consider when deciding to outsource or DIY:

There’s no right way, why not both?

The truth is, developing an investing style that prioritises based on your needs would be the best strategy for you. This could mean adopting both outsourcing and DIY could help you achieve the best of both worlds of prioritising important needs and developing a sound portfolio.

Some common advantages of outsourcing include:

-

Using the extra time gained to grow your capital income

-

Practice creating discipline and commitment to your financial goals

-

Having someone to diversify your portfolio and lowering your risks.

Previously in our article, we shared that it may be a better option for young investors with low capital to consider outsourcing to fuel their ability to grow their capital income.

On the other side of the story, DIY investing opens the doors to:

-

Develop your own investing skills

-

Building your emotional competency

-

Learning to make decisions with limited information available — a priceless life skill

After all, you can only know after you’ve tried and you’ll get more comfortable with the ups and downs of investing.

Case Study

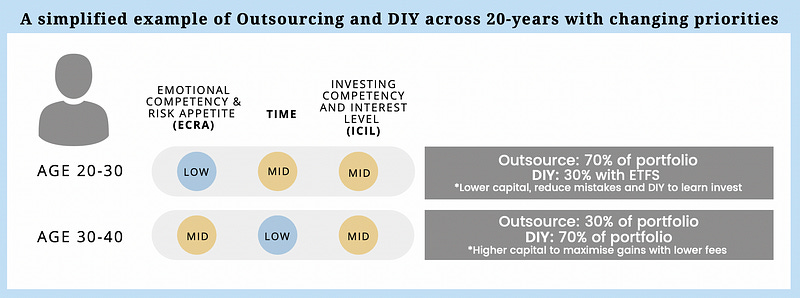

We’ll break it down further, let’s take a look at a simplified example of our financially savvy friend who has mapped his 20-year investing strategy by adopting both outsourcing and DIY. (Note that there isn’t a right or wrong. It boils down to individual preference)

The early 20s

Between the age of 20–30, with low ECRA and mid-level of available time and ICIL, his biggest priority is starting to invest and learn investing skills.

His 70% strategy:

Prioritise: Stay safe and stay invested.

His plan: Opted to seek professionally managed funds and a financial advisor as a big bulk of his portfolio to reduce his novice mistakes as he was eagerly building his earning power more than investing.

His 30% strategy:

Prioritise: Learn investing but safely.

His plan: Consistently dollar-cost-averaging (DCA) the promising ETFs monthly. If time allows, pick one stock with strong conviction. ( i.e. finding a company that he strongly believes will grow in long term)

The early 30s

While between the ages of 30–40, he has less available time, his ECRA and ICIL were mid-level. With more capital for investing and he prioritises maximising return on investment (ROI) by lowering his fees.

His 70% strategy:

Prioritise: Go big and lower costs.

His plan: DIY bulk of his portfolio to lower his fees and increase ROI with experiences he has learned over the past 10 years

His 30% strategy:

Prioritise: Save time and Diversify.

His plan: Outsource to managed funds and/or Robo-advisors to stay diversified

Conclusion

From this example, you’ll see that your investing style doesn’t have a single right answer, it can change depending on your priorities. At the age of 30–40, he has more capital and a sound financial portfolio compared to his 20s, thus greatly boosting his confidence to DIY a bigger part of his investment portfolio. That’s his strategy based on his priorities.

Whether your strategy is a 30–70, a 50–50, or even a 10–90, remember your investing is for the long marathon. As your priorities can change along your investing time horizon, it is also more sustainable and wiser to fit percentages of your portfolio that suit your priorities.

What’s next?

There’s no ‘one single beginner way’ to start, with the plethora of options today, investing is made possible to start with $100 per month. If you know the 8th wonder of the world in finance: Compounding Interest, you would know that the best time to invest was years ago, but you wouldn’t be too far off if you start today.

TLDR: The cost of staying uninvested is definitely more expensive than paying someone to manage your portfolio. Decide on DIY or outsourcing by understanding your needs and prioritising what’s most important to you. Investing is for the long run, there’s no one right way but being consistent.