Singapore's Platform Workers Bill: A New Era of Labor Protection and Its Implications

What the new law means for gig workers, platform companies, and your next Grab ride

Imagine this: You’re scrolling through your favorite food delivery app, craving some bubble tea, when you notice a small note at checkout: “Platform fee increased by $0.50.” You shrug and hit “Order Now,” but here’s the thing—that extra 50 cents is part of a much bigger story. You may have seen news about it, it’s tied to Singapore’s new Platform Workers Bill, a law that’s reshaping the gig economy as we know it.

Starting January 1, 2025, this new legislation is giving platform workers—think our Grab drivers, food delivery riders, and other gig economy heroes—rights and protections they’ve never had before. But what does this mean for workers, companies, and yes, even your bubble tea budget? Let’s break it down.

What Is the Platform Workers Bill? (And why should us, as consumers, care too?)

Here’s the scoop: The Platform Workers Bill is Singapore’s way of addressing the growing gig economy. It creates a distinct legal category for platform workers, ensuring they’re no longer stuck in a gray area between employee and freelancer. Think of it as giving them a seat at the table—or at least a safety net under it.

The law focuses on three key areas:

- CPF Contributions: Ensuring retirement and housing adequacy.

- Work Injury Compensation: Protecting workers if they get hurt on the job.

- Representation Rights: Allowing workers to form and join associations (kind of like unions for the digital age).

But here’s where it gets interesting: These protections come with a price tag. Platform companies like Grab and Gojek are passing some of these costs onto consumers, which is why your ride or delivery might cost a bit more. (More on that later.)

The Big Wins for Platform Workers

1. CPF Contributions: A Safety Net for the Future

Under the new law, platform operators must contribute to both employer and employee Central Provident Fund (CPF) accounts for workers born on or after January 1, 1995. Older workers can opt in if they choose. This is huge—it means gig workers can finally build a retirement fund and save for housing, just like traditional employees. Not forgetting that employer contributions are about 17% of the employee’s salary, so that’s a lot of money. For more information on CPF contributions, visit the CPF website.

“Increased CPF contributions will be mandatory for platform workers born on or after Jan 1, 1995. Older workers may also opt in if they want to.” – Channel News Asia

2. Work Injury Compensation: No More “You’re On Your Own”

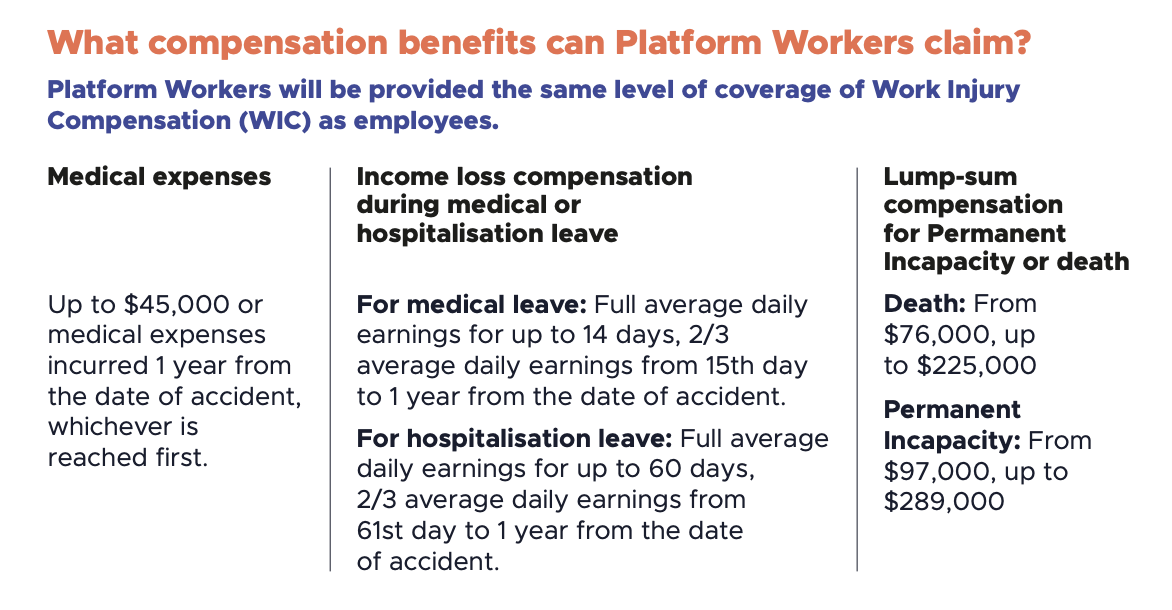

Ever heard horror stories of delivery riders getting into accidents and having no recourse? The new law changes that. Platform workers are now covered under the Work Injury Compensation Act, meaning they’ll get financial support if they’re injured on the job. Under this act, the platform worker is entitled to have the same level of coverage as employee.

Platform worker injury compensation. Source: Ministry of Manpower

3. Representation Rights: A Voice in the Gig Economy

Platform workers can now form and join registered platform work associations. These groups can negotiate with companies on issues like pay and working conditions. It’s a big step toward giving gig workers a collective voice.

“The right of workers to form and join registered platform work associations is explicitly protected under the Act, and any infringement on these rights can lead to penalties.” – Digital Policy Alert

What’s in It for Platform Companies? (Hint: It’s Complicated)

For platform operators, the Platform Workers Bill is a mixed bag. On one hand, it brings clarity to their responsibilities. On the other, it means higher costs. Companies like Grab and Gojek are already adjusting their business models to comply with the new rules.

The Cost of Compliance

To cover the increased CPF contributions and other obligations, some platforms are raising their fees. For example, ride-hailing operators in Singapore are increasing platform fees by up to S$0.50 starting January 1, 2025.

“Four ride-hailing operators in Singapore will be raising their platform fees by up to S$0.50 from Jan 1, 2025, in a move they partly attribute to costs arising from the upcoming Platform Workers Act.” – Channel News Asia

But here’s the twist: While these fee hikes might annoy consumers, they’re a small price to pay for better worker protections. After all, who wants to sit through a ride with their Grab driver complaining about their retirement? 👀

The Ripple Effect: What This Means for Consumers

Let’s be real: No one likes paying more for their hail ride or food delivery. But here’s the thing—those extra cents are going toward something meaningful. By supporting fair wages and protections for gig workers, we’re helping build a more equitable economy. And let’s face it, we were living on borrowed time—it was inevitable that regulations would catch up with these innovative business models.

Platform fee changes. Source: Daretofinance Instagram

If the price increases feel too steep, remember that we always have alternatives—whether it’s taking public transport, walking for shorter distances, or cooking at home instead of ordering delivery.

The Bigger Picture: A Global Trend?

Singapore isn’t alone in this. Countries around the world are grappling with how to protect gig workers while keeping the gig economy thriving. The Platform Workers Bill could set a precedent for other nations, showing that it’s possible to balance worker rights with economic growth.

But as with any major change, there are challenges. Some critics worry that higher costs could lead to fewer job opportunities for platform workers. Others argue that the law doesn’t go far enough in addressing issues like algorithmic bias and data privacy.

Key Takeaways: What You Need to Know

- Platform Workers Bill: A new law in Singapore that protects gig workers with CPF contributions, work injury compensation, and representation rights.

- Impact on Consumers: Expect slightly higher platform fees, but it’s for a good cause.

- Global Implications: This could inspire similar laws in other countries, reshaping the gig economy worldwide.

So, the next time you see that extra 50 cents on your Grab receipt, remember: It’s not just a fee—it’s a step toward a fairer future for gig workers!