Is having late-stage Critical Illness insurance enough?

Do you really need early critical illness insurance?

Being diagnosed with Critical Illness is something that we wouldn’t wish upon anyone. Besides the health aspect, it is also financially distressing. Typically, when one is diagnosed with a critical illness, they would want to have the option of taking time off work, not just a few days but a matter of years. During these years of unemployment and non-salaried period, one would have to rely on their critical illness insurance payout or/and their savings.

That’s why having critical illness insurance is extremely important. But if you are currently making a decision to get any critical illness plan, you may realize that there are 2 main types of critical illness insurance— Early-stage and Late-stage insurance.

This article will explore the difference between the two, ultimately giving you some guidelines to decide if having a late-stage critical illness plan alone is sufficient.

Caveat

We are not from a medical profession, the medical terms mentioned in this article are based on online resources and our interpretation of them. If you spot any mistakes in the interpretation, do kindly inform us.

Difference between Early Critical Illness and late-stage critical illness insurance

Typically, early critical illness (ECI) is a subset of late-stage critical illness (CI). So whatever that’s covered in CI will also be covered in ECI. The main difference in the ECI plan is that ECI covers conditions prior to CI and ultimately it covers when it’s not severe yet.

At this point, it may seem like ECI is better. But it comes at a price, literally— it’s significantly more expensive. Here’s where the dilemma comes in, is it worth it to pay more for ECI coverage? What is the statistic that can help to justify the ECI plan? Read on to find out more!

Definition

It can be hard to find an overall statistic to support this, so instead, we will look into the common critical illness in Singapore — Cancer.

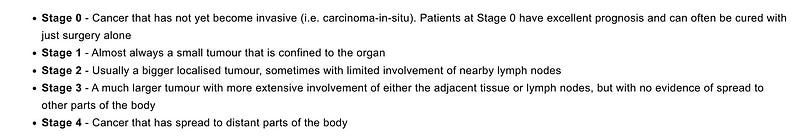

source: Parkway Cancer Centre

Cancer is typically identified based on its stages, as you can see from the image above, cancer at stage 0 is significantly less life-threatening. But based on the stages alone, it can be hard to determine what can be claimable under CI and what is limited to ECI. A snapshot of the definition of Major Cancer in the Life Insurance Association Singapore (LIA) is attached below. Generally, all insurance companies follow the definition set out by LIA.

Source: LIA Singapore

It can be hard to visualize what is claimable under CI if you come from a non-medical background. So it might be easier to focus on what’s excluded in the definition. So let’s focus on 2 segments of the exclusion — Non-invasive and Carcinoma-in-situ.

Non-invasive cancer refers to cancer that stays in the original tissue and does not spread around the body. Referring back to the definition of the different stages of cancer, it is likely to be identified under stage 1. As for carcinoma-in-situ, it would fall under stage 0.

Cancer stage statistic

With the information above, we can say with some degree of confidence that cancer identified as stage 0 and stage 1 are unlikely to be claimable under the CI definitions and only can be claimed if you have ECI coverage. So let’s look into some statistics on the distribution of cancer stages.

Source: Health Promotion Board

As you can see from the table above, the point in the detection of cancer stages varies with different types of cancer. Focusing on breast cancer (within 2018–2019), the most common cancer for females, you’ll see that 56% of all breast cancer occurrence was detected during stage 1.

Another observation is that as time progresses, more cancers are detected during the early stages. For instance, between 2003 to 2007 only 1% of male prostate cancer was detected in stage 1 while it’s 14.7% in 2018–2019.

Given the current trend and with medical advancements, it is likely that more and more cancer detection will happen at the early stages. (that’s great news- the earlier the detection, the higher chance we have of full recovery)

Thoughts

A late-stage critical illness plan does serve its purpose, giving you the financial capability to quit your job and focus on recovery in the unfortunate event of critical illness. However, it’s something that blatantly can only be claimed in the later stages. It is crucial to have some form of early critical illness (ECI) insurance, given that early detection is increasingly common. Most importantly, you would like to make the claim as early as possible and have the choice to focus entirely on your recovery if need be.