How do the new home purchase rules affect you?

A closer look into the new property cooling measures

You may have heard of the new property cooling measure that the government just dropped on us by now. Although it was kind of expected given that many HDBs sold hit the $ 1 million threshold, the measures came a lot sooner than anyone would have thought.

In this article, we will dive deeper into the new measure, explaining it simply and how it might affect you.

Overview of measures introduced

-

Stricter loan eligibility calculation

-

Lower LTV limit on HDB loans

-

15-month wait-out period when switching from private to HDB

Stricter loan eligibility calculation

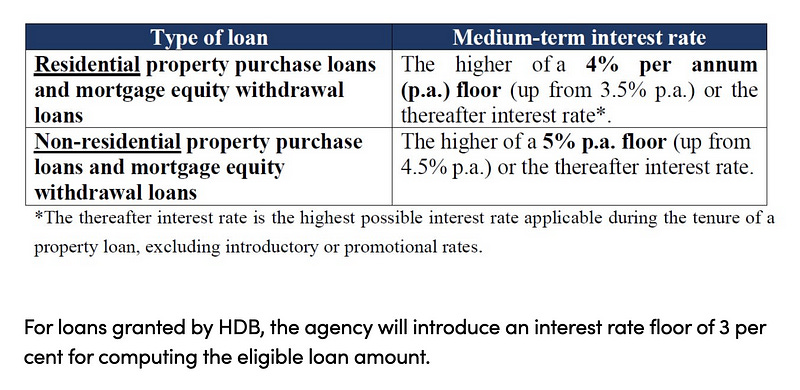

The floor in interest rate in calculating the loan amount has been increased by 0.5%. This will reduce the amount of loan that you can get.

To understand how exactly this affects you, you’ll need to understand the Total Debt Servicing Ratio and Mortgage Servicing Ratio.

MSR is for HDB or an EC, which restricts your mortgage loan’s monthly repayment to 30% of your income. If you’re earning $10,000, your mortgage payment can’t be more than $3,000. As for TDSR, it takes into other liabilities as well and restricts your monthly loan payment to 55% of your income. So if you’re earning $10,000 and have an ongoing car loan of $2,000, you are left with just $3,500 every month for your private housing loan.

Now that you understand how TDSR and MSR work, let’s see how this new floor affects you. How much you can loan will depend on 3 things — TDSR/MSR, duration of the loan, and the floor interest. The floor interest is almost like a “play safe” rate that helps you calculate how much your monthly repayment will be.

To illustrate this, let’s take a look at a typical HDB loan with a max tenure of 25 years. With a combined income of $6,000, the monthly mortgage repayment can’t exceed $1,800. Previously, when the floor interest rate for HDB loans was 2.6%, the max loan amount was $397K. But with the new floor interest rate, you can only loan $358K. That’s about a 12% decrease from the previous value.

Lower LTV limit on HDB loans

Secondly, there will be lower Loan-to-Value on HDB loans, decreasing from 85% to 80%. What this means is that you’ll have to fork out a higher downpayment for your HDB flat, there isn’t really more that needs to be explained.

A 15-month wait-out period when switching from private to HDB

If you are below 55 years old, currently own private property, and have an intention to downgrade, this new measure can be very restricting. You will now have to wait for 15 months after you sell your private property before you can purchase a resale HDB flat.

This means that you will have to either stay at your relative flat or rent a flat during this 15 months wait. Given the high rental cost now, you can expect to fork out $3,300/month for a 3-room flat located at Woodlands.

Although, it is worth noting that this is a temporary measure and may or may not be here to stay.

Conclusion

While these property cooling measures were put in place with the intention to better manage the demand for resale homes, it puts added pressure on the ability to borrow. Overall, with such big financial decisions it’s crucial to be aware of the terms and plan ahead.