How do I pick the best maternity plan?

Your mum-to-be guide on understanding the insurance plan and what to look out for

When it comes to being pregnant, there’s so much to think about — from arranging doctor’s appointments and preparing mentally and physically for the baby to keeping yourself healthy.

Amongst the checklist of things that you have to do, an important one would be to get your maternity insurance. In this article, we aim to highlight what it is, the coverages that typically entail, and what are things to look out for.

What is Maternity Insurance?

A Maternity insurance plan (sometimes called pregnancy insurance) is an insurance policy that covers the expenses incurred from unexpected pregnancy, congenital, and labor complications that may involve the mother and/or the child. In a gist and its simplest form, Maternity Insurance provides financial security by giving a lump sum cash payout if the unfortunate were to happen. Of course, it does include more benefits, which will be elaborated on further in this article.

What should maternity insurance cover?

While each plan offered by the different insurance companies varies, there are some core features that a maternity plan should cover. For ease of understanding, I’ve split the coverage into necessary ones for the mum and the child.

Coverage for the mother

_**(a) Pregnancy complications benefit

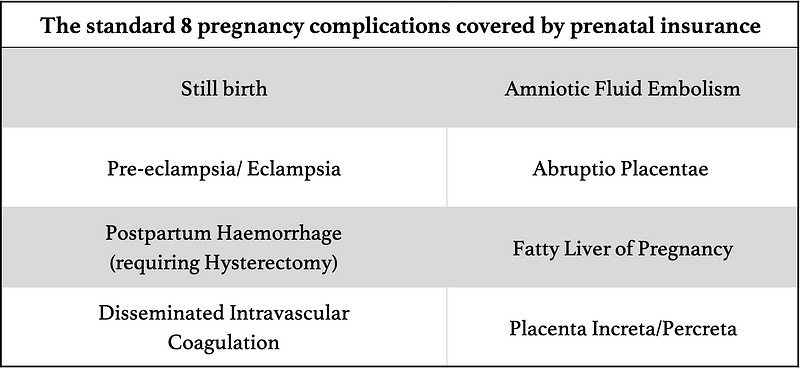

**_This is the most important coverage and is applicable in the event that the mother is diagnosed with any pregnancy complications, they would get a lumpsum payout. It will cover about 8 different types of pregnancy complications and post-childbirth conditions. The number of complications covered varies with each product, so look into this area when researching. Here are some common complications you would definitely want coverage for:

(Just for reference, 14 congenital illnesses are covered under AIA’s Mum2baby Prenatal rider plan which has the highest coverage at the time of writing.)

(b) Hospitalisation Benefit Get daily cash benefits for each day the mum is hospitalised due to pregnancy complications. Or a lumpsum payout for major hospitalisation, such as being admitted to Intensive Care Unit (ICU).

_**(c ) Death and Total Permanent Disability(TPD)

**_In the event of death or TPD of the mother, a lumpsum payout would be given.

Coverage for the baby

_**(a) Congenital illnesses

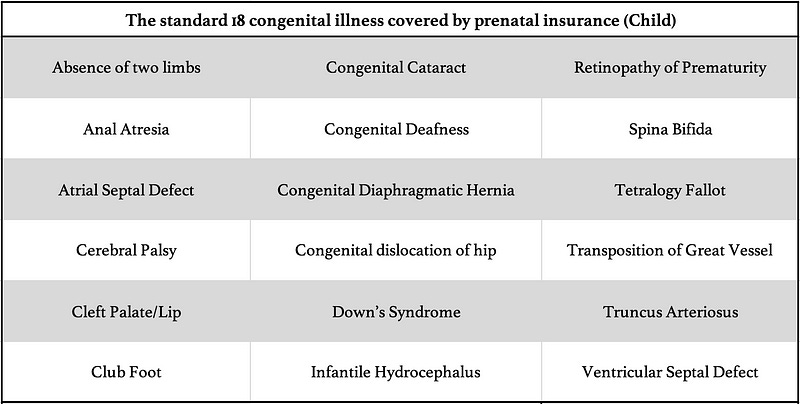

**_This is another essential coverage and is applicable in the event that the child is diagnosed with any illness, a lumpsum payout would be given. The number of complications covered varies with each product, so look into this area when researching. Here are 18 common congenital illnesses you would definitely want coverage for:

(Just for reference, 25 congenital illnesses are covered under AIA’s Mum2baby Prenatal rider plan which has the highest coverage at the time of writing)

_**(b) Hospitalisation benefit

**_Get a daily cash benefit for each day the baby is hospitalised due to covered complications. This is especially important if the baby is admitted to ICU or High Dependency Unit (which is more common than we think) within days of birth and can easily rack up quite a bill.

You would want to note the “Hospitalisation Events” that allow for a claim within this coverage. Some may include Hand Foot & Mouth Disease(HFMD), incubation of newborn, Pneumonia, Bronchitis, premature birth, and severe neonatal jaundice.

_**(c ) Death benefit

**_Get a lumpsum payout in the event of the child’s death.

_**(d) Guaranteed insurability Benefit (GIB)

**_Ensures your child is guaranteed insurable and able to get insurance coverage even if they are born with a medical condition. If not, one may get rejected by insurance companies in an event of a pre-existing condition. This is more important than it seems. If the child is born with a condition, this may be the only health insurance he would ever get in his life.

An additional coverage- Childbirth Negligence Medical Benefit

What is Childbirth negligence?

It is when there is a failure to exercise an accepted standard of care in medical professional skills or knowledge, resulting in injury, damage, or loss in the childbirth process. Additionally, substandard care causes personal injury to the mother or baby which may eventually lead to death in this crucial period.

Some common acts of medical negligence during childbirth include:

· Failing to detect fetal distress or properly monitor the baby’s heartbeat

· Failing to prevent or treat severe tearing or bleeding in the mother

· Failing to perform a medically necessary C-section (cesarean section)

· Pulling or twisting too hard on the baby as they exit the birth canal

All of these acts of medical negligence can result in direct harm to the mother and the baby. If there is evident childbirth negligence that has led to either the death of the mother or child, the medical benefit would kick in and a lumpsum would be given.

When can you purchase one?

Being pregnant puts you at high risk, especially during the early stages of it. That is why you can apply for one as early as 13 weeks into the pregnancy or your 2nd trimester.

It’s best to purchase one as early as possible; it can help protect against any unexpected complications. Even the slightest complication such as gestational diabetes will affect your ability to get a maternity plan. Moreover, as with all insurances — you want to apply for it when you (and your baby) are healthy and without any preexisting conditions.