Essential medical insurance to get your parents

Your Singaporean guide to outsourcing the financial risk of your aging parent's medical bills

For many of us, part of our adulting journey involves financial planning for our parents as well. And in this process, insurance is often one of the biggest topics.

Insurance can be a difficult topic to discuss with your parents, especially with it being seen as a taboo associated with death. However, our parents need to have adequate insurance coverage so that we can better care for them without having financial worries.

In this article, we will discuss the essential insurance that you can consider getting for your parents should you be helping them with financial planning or supporting them.

Understanding Insurance

Due to their old age, things may be slightly more complicated when it comes to planning for them. Before we move on to explain the kind of insurance they need, it would be good to have a rough understanding of how insurance works.

To simplify it, insurance is basically a risk-pooling system, where everyone chips in money into a central fund with the promise that if any individual needs to make a claim, they will be able to do so.

To protect every other consumer, the insurance companies will have to filter out or charge the consumers who already have an existing condition with a higher premium. Basically, if someone is more likely to make a claim from the pool, there would have to contribute a little more. Otherwise, the fund will soon be running out of balance.

What this means is that, if your parents have any existing condition(s), it is highly likely that there would be some exclusion or in the worse case unable to get insurance at all. Having a condition/ injury excluded from insurance means that any medical bill(s) that is associated with the existing condition will not be covered by insurance.

On top of that, due to their older age, the cost of getting them insured is definitely more expensive than yourself. Despite that, it might still be worthwhile to get the essential insurance covered. After all, there are still possibilities of other illnesses/injuries.

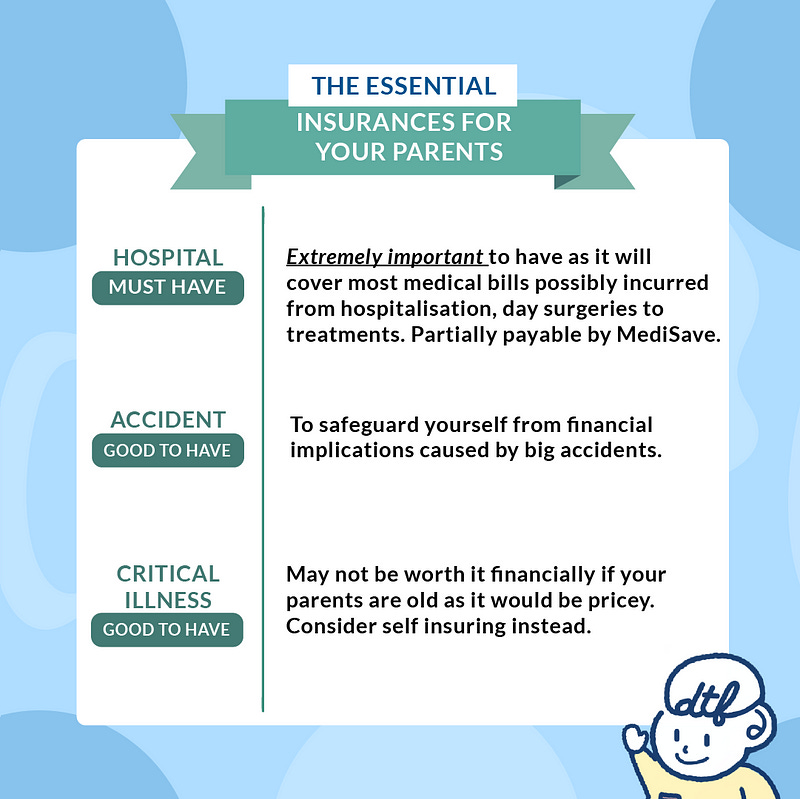

Hospital Insurance

Hospital Insurance or an integrated shield plan remains to be the most essential insurance regardless of your age. It covers the broad medical cost from hospitalization to day surgeries to treatments. To understand more about hospital insurance, you may check out the post that we did earlier on Instagram.

As our parents age, the probability of them needing hospital medical attention increases. Therefore, ensuring that they have the basic hospital coverage greatly reduces the risk of having to fork out a big sum of money for their potential medical bill.

In general, there are 3 different tiers of hospital insurance, private hospital, public hospital (up to A-ward), and public hospital (up to B1 ward). When deciding which tier to get greatly depends on your parents’ comfort level and your budget.

Accident Insurance

It is a commonly known fact that the elderly are more prone to accident-related incidents. A simple fall that caused a bruise when we were young may be bone-breaking in old age. That is why having an accident plan might be a good idea.

We personally don’t see an accidental plan is essential for your parents but a good one to have. A basic accident plan would generally cover you in the case of accidental death, accidental disability, and accidental medical reimbursement. The idea of medical insurance is to cover potential big medical costs. Since the death of your parents would not be affecting anyone financially there isn’t really a need to be covered for accidental death. As for accidental disability, the compulsory disability care medical insurance in Singapore, CareShield Life, acts as good enough basic protection for any potential accidental disability. If your parents are still holding on to ElderShield, we would highly recommend you consider switching to CareShield. You may also look into purchasing riders above it if you choose to omit personal accident insurance for your parents.

Lastly, the accidental medical reimbursement might be good to have. Accidental medical reimbursement basically allows one to claim for any injury that is a result of an accident. This includes an injury from a simple fall. And since the elderly are more prone to such occurrences, there would be a chance to benefit from this plan. However, since such medical expenses usually don’t amount to much, not having an accident plan will most probably not lead to a financial burden.

Critical Illness

A critical illness plan is one of the essential insurance that almost everyone should get. In a gist, it gives a sum of money to the insured upon a diagnosis of a critical illness. Although it is often seen as an essential, it might be just too expensive for anyone to get for their parents due to old age. And because of that, it might not be worth it to get any for them.

Thankfully, most of the medical costs associated with having a critical illness can be paid for with hospital insurance (hence if there’s anything you take out of this article, the minimum you should get your parents is a Hospital plan). However though, when it escalates to bills beyond hospital insurance, then one will simply have to fork out from their own pocket. Such possible expenses include hiring a trained caretaker, taking unpaid leave to accompany your parents to treatment etc.

To mitigate such a situation from happening, we can only emphasise on encouraging them to lead a healthy lifestyle and be a little more conservative with our investment portfolio.

Summary

All in all, the only essential insurance that you must get for your parents is Hospital insurance. The other insurance serves more like a “good-to-have”.