Cost of buying a brand new car in 2022

All the underlying costs of a car purchase in Singapore

The price of a car in Singapore is well-known for being expensive. In fact, the cost of car ownership in Singapore is ranked the most expensive in the world. Despite its insane pricing, having a car in Singapore remains a dream for many.

In this article, we will break down the cost you have to account for when you purchase a brand new car in Singapore. To illustrate this example, we will be looking at one of the more affordable cars in Singapore, a Mitsubishi Attrage.

Open Market Value (OMV)

OMV is the price assessed by Singapore Customs. This basically refers to the cost of importing the car into Singapore. To get an average of the OMVs throughout the years, you may check out this website by LTA here.

Interestingly, you will be able to get a portion of OMV back if the vehicle gets de-registered within 10 years from the first registration date. The actual amount that you get depends on when you deregister and the type of car. More information about it can be found here.

The OMV of a Mitsubishi Attrage as of March 2022 is $14,739

Yes, this means that besides Singapore, almost the rest of the world only has to pay $14,739 to get the car.

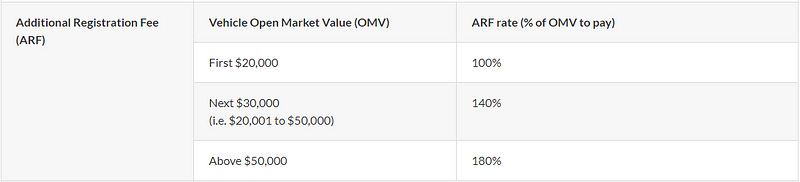

Additional Registration Fee (ARF)

ARF is a tax imposed upon the registration of a vehicle. It is calculated as a percentage of the OMV.

Source: One Motoring LTA

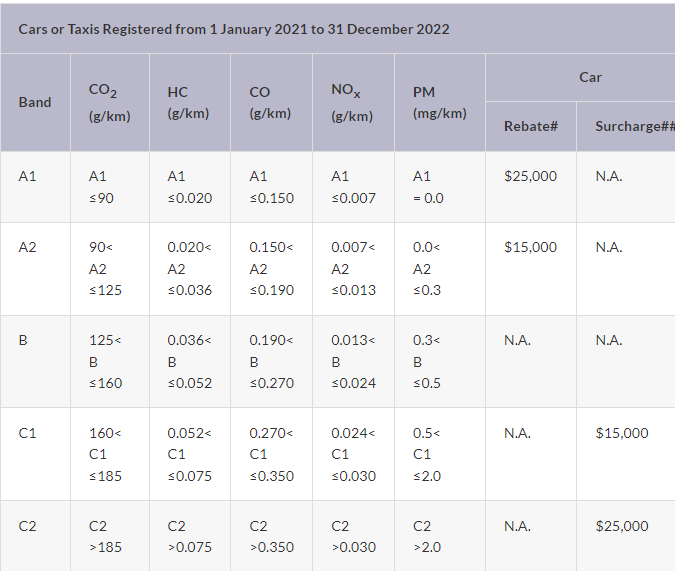

On top of this, there is Vehicular Emissions Scheme (VES) which basically encourages you to buy a car that emits fewer pollutants. In other words, if the car has cleaner emissions, you will be able to offset the ARF with rebates. This VES will also affect the amount of value you will get when you de-register your car within the next 10 years.

Source: One Motoring LTA

I am not sure how this VES is calculated but according to the sgCarMart website, the VES rebates add up to $15,000 and so the ARF is calculated to be $0 for a Mitsubishi Attrage as the VES rebates amount to be more than the OMV. However, there is a minimum ARF payment of $5,000

Excise Duty And GST

This is another form of tax imposed on cars in Singapore. This excise duty is calculated based on 20% of the OMV value of the car. On top of this, another 7% GST would be added.

This will add up to $2,947.80 excise duty and $1,238 GST for Mitsubishi Attrage

Certificate of Entitlement (COE)

COE is basically the 10 years license to drive the car out on the road. The price of the COE largely depends on the demand of the market. In other words, there will be times when the COE is insanely expensive and there will also be times when it is cheap.

As of March 2022, the cost of COE for Mitsubishi Attrage is $68,501

Local Dealers’ Margin For Cars In Singapore

Local Dealers’ Margin basically refers to the fee you have to pay to the dealer for the business. After all, nobody would run a business without a way to profit. This amount varies with each dealer but according to dollarsandsense, this amount ranges from about 15% for affordable brands to as high as 50% or more for luxury brands.

Total cost

So to add all the costs up the total basic cost will follow this formula by sgcarmart.

Total Basic Cost = OMV + Custom duty + GST + ARF + Registration fee + COE + VES surcharge

For the case of Mitsubishi Attrage:

$14,739 + $2,947 + $1,238 + $5,000 + $220 +$68,501 = $92,645

On top of this basic cost, the dealer will charge a percentage of the premium as explained above. With all this added into consideration, the initial price of $14,739 ballooned to about $99,999 (after adding the dealer’s margin)

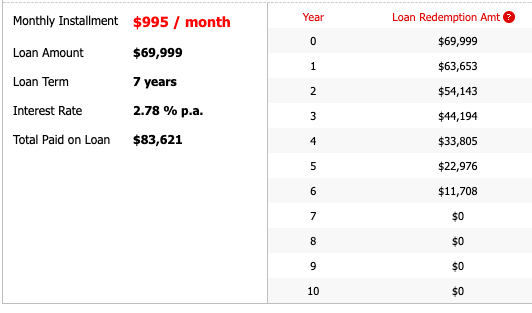

Getting a loan for the car

To get a deeper understanding of the cash outlay needed when purchasing a new car, you would need to understand how a car loan works in Singapore.

Firstly, the car loan amount depends on the OMV of the car. If the OMV of the car is less than $20,000 as with the Mitsubishi, the loan amount would be 70% of the purchase price. But if the OMV is above $20,000, the maximum loan available would only be 60% of the purchase price.

Secondly, the maximum loan period for the car is up to 7 years. However, the maximum loan period is also dependable on the registration date of the car. You may read more about it here.

Lastly, it also depends on your current financial commitment. The total debt servicing ratio (TDSR) is a framework introduced by MAS in 2013 to ensure that Singaporeans borrow responsibly and aren’t overburdened by debt. Based on this, it limits your monthly loan amount to be 55% of your monthly income. This means that if you are earning $6,000 per month, the total loan repayment amount is capped at $3,300. So if you already have lots of loans on hand, you may not be able to get as much for the car loan.

So assuming that you meet the TDSR requirement and wish to stretch the loan to its maximum tenure, here is what it make look like:

Source: sgcarmart

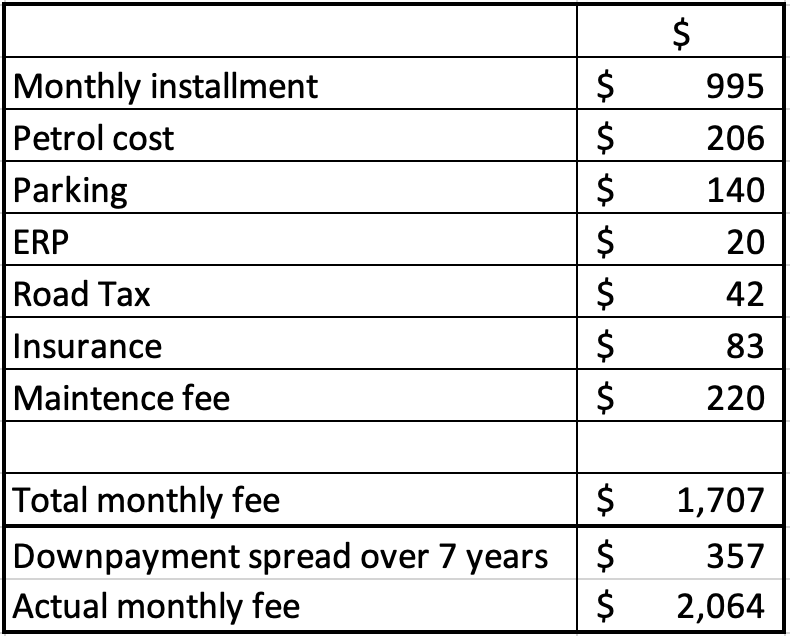

Other variable costs

Besides the upfront cost of getting a car, what’s even more expensive would be the maintenance and running costs.

Petrol cost

By now, you may have heard the news that the price of petrol has increased significantly. But how does that affect the cost of owning a car? To estimate this, we will take the average annual mileage of a car to be 17,500 km. The Mitsubishi Attrage has a fuel consumption of 20.4 km/L. With these, if you were to get this car, you would have a consumption of 823 litres in a year, which is around 69 litres per month. Based on the latest petrol price of $2.99/litre, that would be a cost of around $206.31 per month.

Parking

Another cost to consider would be the parking cost. If you live in HDB, a monthly seasonal parking pass would be around $110, along with the other parking fees which you would naturally incur which would amount to around $140.

ERP

Electronic Road Pricing (ERP) needs no further explanation, we all learnt it during our school days. Again, the amount you need for this varies significantly, but for the sake of conservative planning, let’s assume it to be around $20.

Road Tax

When you are driving on the roads, you would have to pay taxes too. The exact cost of road tax depends on variables such as the vehicle’s Engine Capacity and age. The Mitsubishi car in our example above would be around $506 per year.

Insurance

Our car needs insurance too, but unlike your personal insurance, car insurance is compulsory in Singapore. The cost depends on your age, occupation, driving experience etc. In this example, we will just assume that the insurance cost is around $1,000.

Maintenance

Unfortunately, the car may breakdown and require maintenance once in a while. And every time it breaks down, you will need to pay for its servicing cost. According to valuechampion, the average cost of car maintenance is around $2,640 per year.

Adding all the costs together

Adding on all the costs together, you can see that the monthly fee of owning a car escalates to around $2,064. And the median monthly salary for Singaporeans? Around $4,680 according to MOM website (including Employer CPF Contribution). After deducting CPF contribution, that would amount to just around $3,744. If your salary is your only source of income and you own a car, you are essentially funding 55% of take-home pay into your car. And when you are co-sharing the car with your partner (assuming the same level of income) that would be around 27% of your income.

Should you buy a car?

Well- this really depends on what the car would serve for and from a financial standpoint, I guess if you can afford and validate the purchase? But most importantly, you must recognise the cost of it. If it is a life goal and you are planning and saving towards it, why not.

Conclusion

At this point, you may have noticed that most of the additional cost of the car is pegged at the OMV. This means that the cost of a car greatly depends on the brand. But what’s more expensive than owning a car in Singapore is the cost of maintenance. Getting a car in Singapore is not a decision to be taken lightly. If you are considering getting a car, do give some serious thought about it and only get it if you can afford it.

Find out if you can afford it with our software

Why not try out the DaretoFinance Financial Pathway, our in-house built goals planning software! Map your major life stages like becoming a homeowner, building a family, retirement, and the likes of it (of course, customising it cause we all have different milestones and goals!) to ultimately visualise your journey towards financial freedom on a dashboard software we’ve created. For more information check out our “Pathway” Instagram highlights.

Have a better understanding of how much these milestones (short to long term goals), perhaps a purchase of a car, would cost and understand whether they are feasible with your current financial trajectory. Comfortably reach your goals without sacrificing the little things you want in your life.