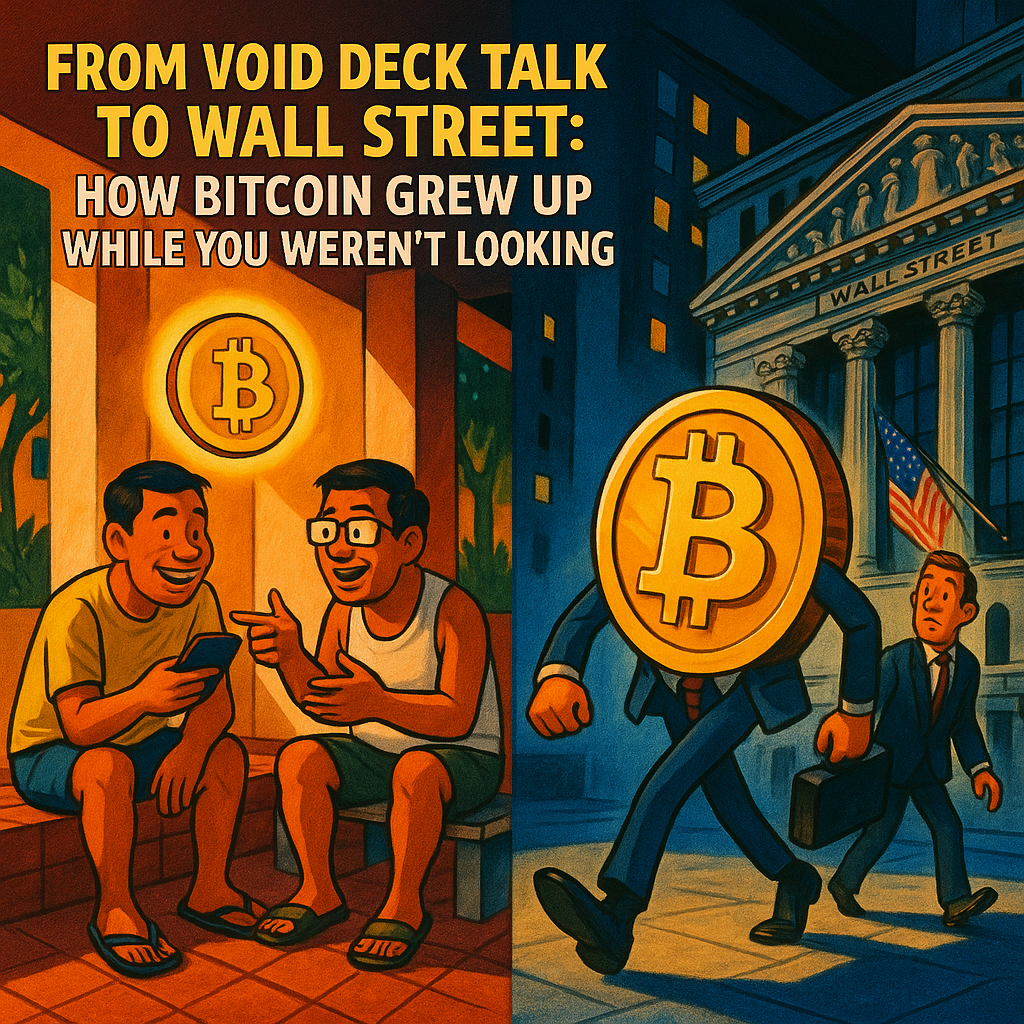

From Void Deck Talk to Wall Street: How Bitcoin Grew Up While You Weren't Looking

How Bitcoin glow up from internet money to institutional asset

Remember 2021? Back when everyone from your Grab driver to your neighbour auntie was talking about Bitcoin and Dogecoin? You probably bought some cryptocurrency because your WhatsApp group chat wouldn’t stop sharing rocket emojis and “diamond hands” memes. Then the market crashed, you stopped checking your crypto app, and life moved on.

Fast-forward to 2025, and Bitcoin has quietly hit new record highs at $120,000 USD while you’ve been busy with everything else. If you’re wondering what happened while you weren’t paying attention, think of it this way: crypto went from being the topic of void deck conversations to something your bank’s investment advisor might actually recommend.

Here’s what changed, why it matters, and what it means for that crypto you bought and forgot about.

The Great Crypto Growing Up Story

Let’s break down the three distinct phases that brought us to where we are today:

2021: The “Everyone’s An Expert” Phase This was when crypto felt like a get-rich-quick scheme that everyone could access from their phone. Social media was flooded with success stories, Elon Musk was tweeting about Dogecoin, and NFT art was selling for more than a condo. The pandemic had given people extra time and stimulus money, creating perfect conditions for speculative investing.

2022-2023: The “Reality Check” Phase Then came the crashes that wiped out $2 trillion from the crypto market. Major disasters like the Terra Luna collapse (which lost $60 billion overnight) and the FTX exchange scandal (where founder Sam Bankman-Fried was later sentenced to 25 years in prison) shattered confidence. Many people lost money, trust evaporated, and crypto felt like a cautionary tale.

2024-2025: The “Adults in the Room” Phase This is where we are now. Major financial institutions have embraced Bitcoin, proper regulations are in place, and corporations are adding Bitcoin to their balance sheets as a serious investment. The wild west atmosphere has been replaced by something that looks more like traditional finance, but with Bitcoin’s unique properties intact.

Why Wall Street Finally Said “Yes” to Bitcoin

The biggest change has been institutional adoption. Think of it like this: in 2021, crypto was like a neighbourhood kopitiam that only locals knew about. Now it’s become a proper restaurant that even your conservative parents would feel comfortable visiting.

Bitcoin ETFs Changed Everything In January 2024, the US Securities and Exchange Commission approved spot Bitcoin ETFs (Exchange-Traded Funds). This was huge because it meant people could buy Bitcoin through their regular brokerage accounts, just like buying shares in DBS or Singapore Airlines. BlackRock’s Bitcoin ETF alone attracted over $44 billion in its first year. The Bitcoin ETF net asset has even surpassed BlackRock’s gold ETF (which is almost 20 years old)

For context, imagine if the Monetary Authority of Singapore suddenly announced that Bitcoin could be held in your CPF account. That’s the level of legitimacy these ETFs provided in the American market.

Companies Started Treating Bitcoin Like Gold Remember how your grandfather might have kept gold bars as a store of value? Companies are now doing something similar with Bitcoin. MicroStrategy, a software company, has accumulated over 597,000 Bitcoins worth approximately $74 billion. They’re not alone - public companies now collectively hold over 725,000 Bitcoins, representing a 135% increase from 2024.

This isn’t speculation anymore. These are CFOs and boards of directors making calculated decisions about corporate treasury management, the same way they might decide to hold US dollars or government bonds.

The Technology Actually Improved

While you were away, Bitcoin’s underlying infrastructure got significantly better. The Lightning Network, which processes instant Bitcoin payments, now handles tens of thousands of transactions daily with minimal fees. This addresses one of Bitcoin’s biggest criticisms - that it’s too slow and expensive for everyday use.

Think of it like Singapore’s evolution from using cash and cheques to PayNow and digital payments. The underlying money (Singapore dollars) stayed the same, but the payment infrastructure became faster and more convenient.

Bitcoin has also expanded its capabilities. Bitcoin Ordinals and BRC-20 tokens have brought NFT-like functionality directly to the Bitcoin blockchain, while platforms now offer Bitcoin-backed lending services. These developments make Bitcoin more versatile than the simple “digital gold” narrative of 2021.

The Regulatory Environment Cleaned Up

One of the biggest changes has been regulatory clarity, especially in the United States. President Trump’s administration introduced executive orders that fundamentally shifted the government’s approach to cryptocurrency. The “regulation by enforcement” approach that had created uncertainty was replaced with clear guidelines that help businesses operate legally.

In Singapore’s context, this would be like the government moving from “we’ll figure out the rules as we go” to publishing comprehensive guidelines that everyone can follow. The European Union implemented similar comprehensive regulations called MiCA (Markets in Crypto-Assets), providing clear operational frameworks.

What This Means for Your Old Crypto Holdings

If you’re one of those people who bought crypto in 2021 and forgot about it, here’s what you should know:

Check Your Portfolio, But Manage Expectations Bitcoin has recovered and reached new highs, but many of the altcoins (basically all other cryptocurrency) and meme tokens from 2021 haven’t been so lucky. Dogecoin and Shiba Inu, while still around, are worth significantly less than their 2021 peaks. The NFT market has collapsed by over 99% from its $2.9 billion peak.

Security Matters More Now With prices higher and the market more mature, security has become crucial. Consider moving long-term holdings to hardware wallets, as crypto scams stole $7.7 billion in 2021 alone. The “set it and forget it” approach only works if your assets are properly secured.

The Meme Coin Subplot

Interestingly, 2025 began with a throwback to 2021-style meme coin mania. President Trump and First Lady Melania each launched their own meme coins, which quickly reached market caps of $10 billion and $7.2 billion respectively.

However, this meme coin resurgence felt more like an intermission than the main show. Unlike 2021, when meme coins dominated headlines for months, the 2025 version was brief and quickly overshadowed by Bitcoin’s continued institutional adoption.

Looking Forward: A More Mature Market

The crypto market of 2025 looks fundamentally different from 2021. Expert predictions for Bitcoin range from $150,000 to $350,000 by the end of 2025, but these forecasts are now based on institutional adoption rates, corporate treasury strategies, and regulatory developments rather than social media hype.

Supply and Demand Mathematics Bitcoin’s supply is mathematically limited - only 164,250 new Bitcoins will be created in 2025 due to the halving event that occurred in April 2024. Meanwhile, corporate holdings exceed 1 million Bitcoin and continue growing. When demand consistently exceeds supply, basic economics suggests prices should rise.

The Infrastructure Is Ready Unlike 2021’s speculative bubble built on hope and social media momentum, today’s Bitcoin market has the infrastructure of a mature financial asset. Regulated exchanges, institutional custody solutions, clear tax frameworks, and professional investment products all exist.

The Bottom Line

If you bought crypto in 2021 and held on through the crash, you’ve accidentally participated in one of the most significant financial technology transitions of the past decade. The difference is that now, instead of relying on social media sentiment and celebrity endorsements, Bitcoin’s value proposition is supported by institutional adoption, regulatory clarity, and technological improvements.

Whether you choose to stay involved or cash out, at least now you understand what happened while you weren’t looking. The crypto market grew up, and Bitcoin graduated from internet money to institutional asset. Not bad for something that started as an experiment by an anonymous programmer just over a decade ago.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Cryptocurrency investments carry significant risk, and you should only invest what you can afford to lose. Always consult with qualified financial advisors before making investment decisions.