Beyond the Hype Train: Investing After the Bubble Burst

So, are you still investing after the hype train? Let's take a look at what you can do for a better investing journey this 2023

Beyond the Hype Train: Investing After the Bubble Bursts

If you’ve been an investor in the last three years, you know how quickly the tide can turn in the stock market. In 2021, investors were eager to get their hands on the hottest stocks and drive their prices up, seemingly without end.

Soon after in 2022, the same investors who were bullish on the stocks just yesterday are now bailing out, sending prices plummeting and leaving many investors wondering what went wrong — and what they should do next.

Whether you’re a newbie beginning your financial journey or an old-timer searching for ways to properly invest in Singapore and beyond, let’s try to understand what exactly happened in the previous insane year.

Factors That Caused The Stock Market Crash 2022

Let’s first tackle the two main factors that caused the stock market to crash in 2022.

1. Higher inflation: When inflation rises, so do interest rates. This means that investors may be more likely to invest their money in bonds like the Singapore Savings Bond because they offer higher returns with lower risks. As a result, there will be less investment capital available for stocks, reducing demand and lowering prices.

High inflation also makes it harder for companies to increase profits because they have to pay more for goods and services while their revenues remain the same. This can lead to decreased earnings per share (EPS), which is a major factor that drives stock prices up or down. When EPS goes down, usually so does the price of company stock.

2. Supply chain crisis: Other than high inflation rates, mobility restrictions and factory shutdowns from the pandemic and the Russian-Ukraine war have also impeded the sourcing and delivery of materials and products. The combination of these supply chain challenges increases costs for corporations and reduces revenues, which causes stock prices to fall.

Back To Basics: Focus On The Fundamentals

Even though 2022 was a bear market, many companies’ fundamentals remained unchanged. Tesla* is still trying to create the perfect self-driving car. Google* is still innovating its search and advertising services on the Internet. Disney* is still coming up with ways to bring family entertainment and media to new heights (Not a stock recommendation). Even crypto’s functionality still hasn’t changed.

What changed is mostly investors’ sentiments and their short-term outlook. You don’t need a hype train or other people’s opinions to decide if an investment is right for you. Instead, take some time to think about what makes sense for your individual portfolio and goals as an investor.

Understand that market cycles happen all the time. Booms and busts are part of investing, and there is no getting away from them.

Remember to also constantly stay invested because time in the market definitely beats timing the market! If you missed the top ten best days in the stock market, your overall return will be cut in half, according to a 2019 Retirement Guide that studied a 20-year period from 1 Jan 1999 to 31 Dec 2018.

How To Invest In Singapore: Look Beyond The Hype Train

In 2021, investing was trendy, especially for those who just gotten started on their financial journey. There was hype in seemingly dying companies like GameStop that made millionaires overnight. It’s also the era of non-fungible tokens (NFTs) and cryptocurrency. Basically, it felt like almost everyone was not just talking about investing, but also making huge profits out of it.

However, many world events that happened last year like the Russian-Ukraine war, high inflation, and supply chain disruptions have sent the stock markets plummeting. The hype around investments went stale and felt almost like a taboo.

The question is, now that the trend of investing seems to die down, are you still invested when the market conditions are priced into the stock prices?

https://www.toptal.com/finance/financial-analysts/investor-psychology-behavioral-biases

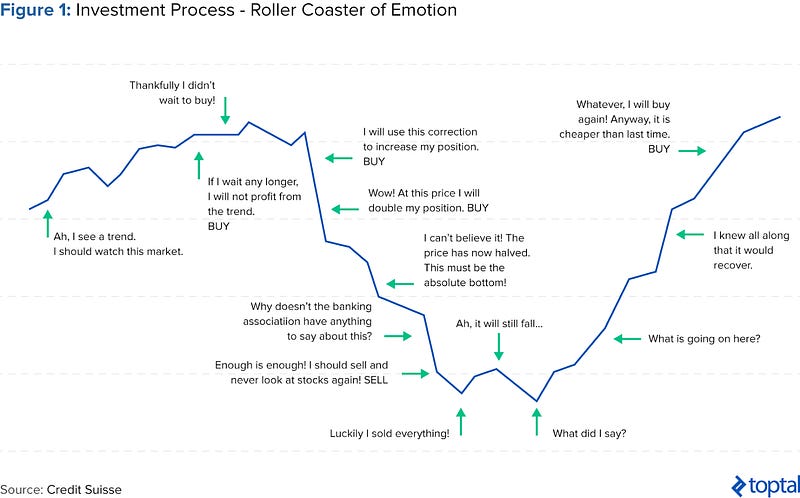

Through this roller coaster emotion chart, you can see that everyone was most likely at the peak of the graph in 2021. Most investors spiralled downwards to the bottom of the graph in 2022.

If you invested in a company at S$100 (peak) in the past because you thought it had potential, why wouldn’t you invest in it at S$50 (bottom) in the present?

It can be difficult to pour in your hard-earned money when market sentiments and outlooks aren’t looking great. But it is important to keep in mind that history has shown that good businesses will survive market downturns and rise to newer heights when the storm is clear.

At the end of the day, do your own due diligence before investing, build up your confidence about your investment, as well as understand the potential risks and biases. The hype around investing may be gone, but the potential for good businesses remains.

Because after all, being a good investor isn’t about investing at the right time but rather investing in good businesses all the time.